The Federal Reserve's continued interest rate hikes have led to a significant rise in mortgage rates, creating challenges for homebuyers and lenders alike. The move, designed to combat persistent inflation, is having a wide-reaching impact on the housing market, raising concerns over affordability and market stability.

While higher mortgage rates are meant to cool down the housing market and prevent the overheating of home prices, they are now creating new obstacles. As the cost of borrowing increases, both first-time homebuyers and refinancing homeowners are experiencing financial strain. In turn, lenders are also facing declining loan origination and increased credit risk.

How Rising Mortgage Rates Are Impacting Homebuyers

1. Increased Monthly Payments

Mortgage rates have risen significantly, with the

average 30-year fixed-rate mortgage now approaching

7%, compared to around

3% just a year ago.

Higher rates translate into

higher monthly payments. A $300,000 loan at 3% would cost a homeowner roughly

$1,265 per month. At 7%, that same loan would require a payment of

$1,996—an increase of over

$700.

For many

first-time homebuyers, this increase has made

homeownership less affordable, pushing them out of the market.

2. Reduced Purchasing Power

As mortgage rates rise, homebuyers'

purchasing power decreases.

For example, a buyer who could afford a

$350,000 home at 3% interest may now be able to afford only a

$275,000 home at a 7% rate. This limits options and may force buyers to settle for

smaller homes or homes in

less desirable areas.

3. Impact on Homebuyer Sentiment

The increase in rates has dampened

homebuyer sentiment.

According to recent surveys,

consumer confidence in the housing market has declined, and

many prospective buyers are delaying their home purchases in hopes that rates will fall in the future.

Reduced inventory due to

sellers hesitating to list their properties at higher rates adds to the difficulties for buyers.

4. First-Time Homebuyer Struggles

First-time homebuyers, who typically have fewer resources and may be more dependent on affordable financing, are especially

vulnerable to rising rates.

According to industry reports, the number of

first-time buyers has dropped by

15-20% over the past year as higher rates have priced them out of the market.

Challenges Faced by Lenders

1. Declining Loan Demand

As mortgage rates rise, there is a marked decline in

loan demand.

Lenders are experiencing a

drop in refinance applications and a slowdown in

home loan originations.

According to the

Mortgage Bankers Association (MBA),

mortgage applications are at their lowest levels in over a decade, as fewer buyers can afford to take out loans.

2. Increased Risk of Default

As borrowers face

higher monthly payments, the

risk of default increases.

Lenders are becoming more cautious in their

lending practices, tightening

credit requirements and conducting more

thorough assessments of borrowers' financial health.

There is also concern about the

increased number of adjustable-rate mortgages (ARMs), which may become even more expensive when interest rates reset in the coming years.

3. Impact on Profitability

Higher mortgage rates may also affect the

profitability of lenders.

With fewer people refinancing, lenders who previously relied on

refinance business may struggle to maintain

profit margins.

Banks are now focusing more on

other financial products, such as

home equity lines of credit (HELOCs) and

personal loans, to offset the decrease in mortgage-related revenue.

The Broader Economic Impact

1. Housing Market Slowdown

The surge in mortgage rates has led to a

slowdown in the housing market.

Home price growth has decelerated, and some areas have even seen

price declines. However, despite the slowdown,

home prices remain elevated due to a persistent

inventory shortage and strong

demand from buyers with higher incomes.

Renting has become more attractive to some consumers, driving demand for rental properties, but also increasing rental prices in some markets.

2. Economic Growth Concerns

A slowdown in the housing market has

broader economic implications.

Housing construction and home sales are critical drivers of

economic growth.

With fewer homes being built and sold,

construction jobs and

related industries, such as furniture and appliances, may experience a

decline.

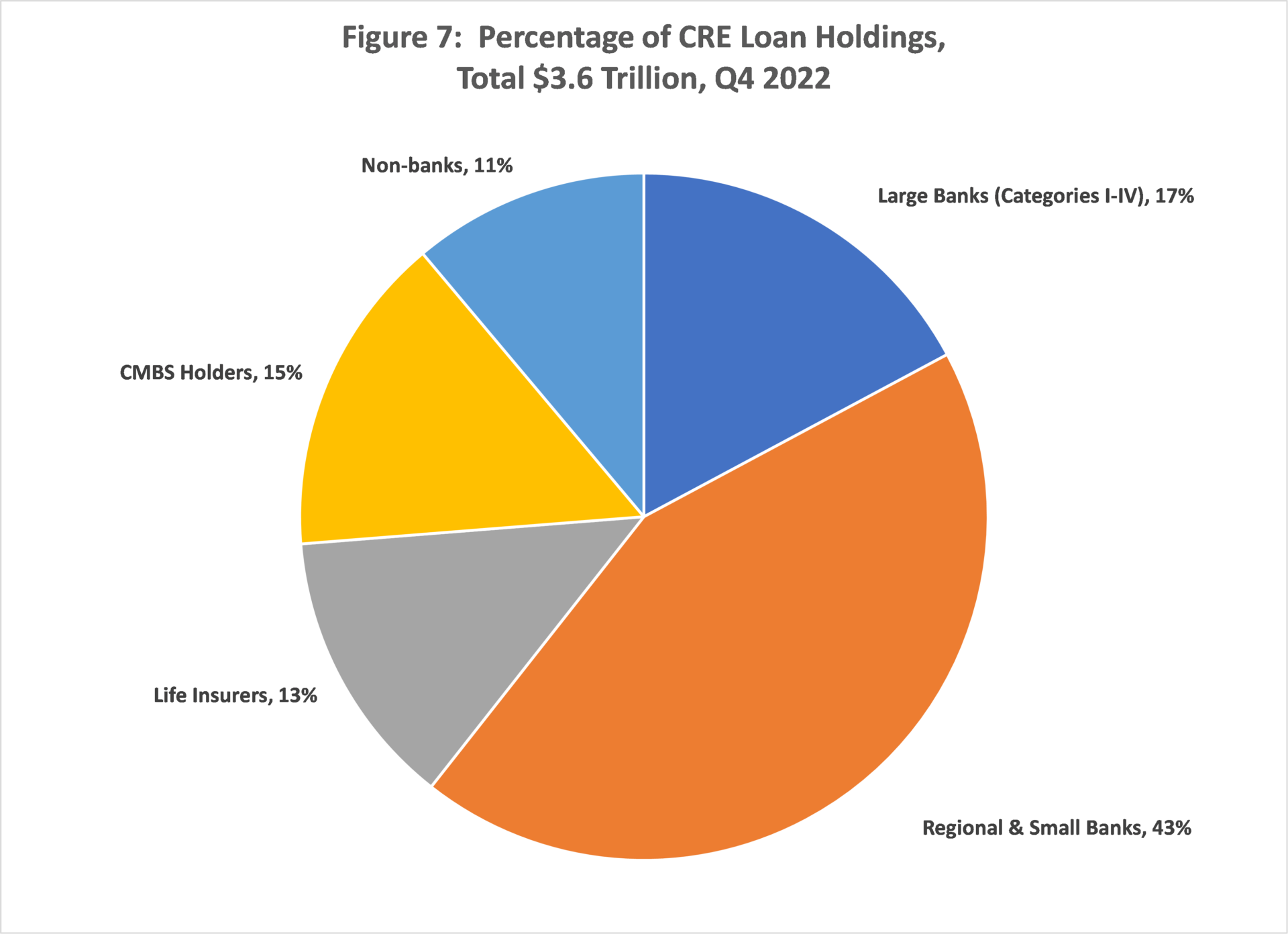

3. Impact on the Broader Credit Market

The increase in interest rates is also impacting the broader

credit market.

Consumers and businesses may face

higher borrowing costs for loans, credit cards, and lines of credit.

As borrowing becomes more expensive, consumer spending may

slow down, affecting the

overall economy.

What’s Next for Homebuyers and Lenders?

1. Homebuyers’ Strategies

For homebuyers, especially

first-timers, it’s crucial to shop around for the best rates and consider

adjustable-rate mortgages (ARMs) for potentially lower initial payments.

Some buyers may need to

lower their expectations in terms of home size, location, and amenities.

Others may opt for

waiting out the rate hike, hoping that the

Fed will reverse course and lower rates in the future.

2. Lenders’ Response

Lenders may continue to adjust their

product offerings, focusing more on

fixed-rate mortgages or

adjustable-rate mortgages for buyers who can handle potential rate increases down the line.

Alternative lending products, such as

rent-to-own options, may become more popular as buyers look for flexible solutions in a high-rate environment.

3. Federal Reserve’s Role

The

Federal Reserve will continue to monitor the economy and make decisions based on

inflationary pressures and

economic growth.

If inflation persists, the Fed may raise rates further, but if the housing market slows too much, it may

reassess its strategy